People have been using PayPal and other services for quite some time to send money to not just friends and family members, but also to purchase products online. The service, however, is not free. PayPal charges a fee for its service, which is a set percentage of the amount that’s transferred. Venmo (a PayPal service), Square Cash, and Popmoney are some of the other services that have been around for years and offer ways to transfer funds electronically.

Zelle is a fast, safe and easy way to send money directly between almost any bank account in the U.S., typically within minutes. 1 With just an email address or U.S. Mobile phone number, you can send money to people you know and trust, regardless of where they bank. 4 Ask your recipient to enroll with Zelle before you send them money – this will help them get your payment more quickly. Open our mobile app Don’t have the Fifth Third Mobile app? You can download it from the App Store. Zelle Carding Method 2021 – The Smart-Lazy-Hustler Background of Zelle Carding. Zelle is a recent mobile payment platform founded in 2017. It allows US residents to send. Requirements to Card. Zelle ® is a great way to send and receive money between friends, family and other people you know and trust 1 — regardless of where they bank 2. Send money directly to your friend or family member’s bank account, typically within minutes 3. Request 4 money. With over 300 payment methods available, buying Bitcoin online has never been easier. From cash and bank transfers to gift cards and payment applications, you can select the option most suitable for you. If you have a preferred payment method that you don’t see, let us know and we will strive to make it happen.

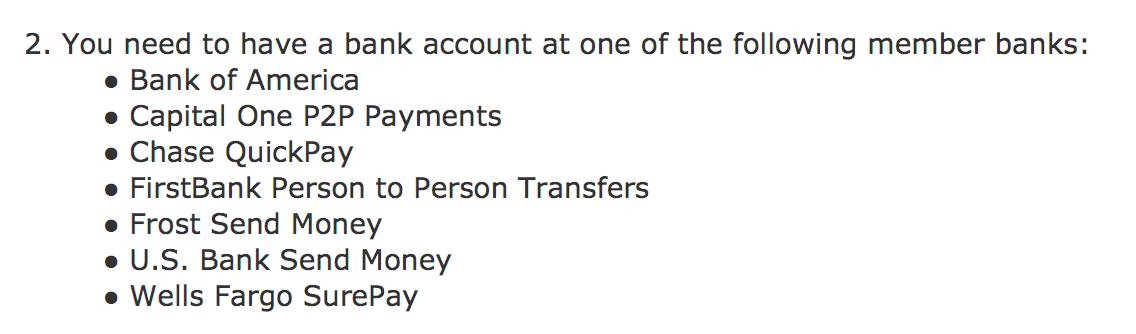

In June 2017, Early Warning Services, LLC launched a digital payment system called Zelle. Early Warning Services is owned by several banks, including JP Morgan Chase, Bank of America, Citibank, Wells Fargo, Capital One, US Bank, PNC Bank, and BB&T Bank. The purpose of the Zelle service is to allow people in the United States electronically transfer funds from their bank to someone else’s bank using either a mobile app or their bank’s Web site. The funds are transferred quickly and there is no fee for the service. That sounds wonderful. So what’s the catch? In this article, I am going to share some of the issues that has made Zelle a security risk for people.

Who Likes to Use Zelle?

Banks and their customers are loving the ease and speed with which the money can be transferred between banks. The hackers and scammers are loving the ease with which they can con people and steal their money because Zelle offers no fraud protection. Luckily, banks have a limit on how much money can be transferred. Each bank sets it’s own limits. For example, some banks allow transferring up to $2,500 per day and no more than $4,000 in a month, while others allow $2,000 per day and and as much as $16,000 per month. Unfortunately, these limits don’t help victims of scams who buy concert tickets or various products from online sellers. Because the banks do not offer any fraud protection to people who use Zelle payment system, people can get scammed for up to $16,000 a month, depending on where they bank.

| Zelle is probably one of the easiest methods to scam people out of money on the Internet. |

What are the Risks Associated with Using Zelle?

Because so many big banks offer Zelle payment service, most Americans naturally assume that Zelle is safe. After all there’s hardly an American who hasn’t banked at one of these giant banks at one time or another in their life. I am talking about banks such as Bank of America, Wells Fargo, Citibank, and Capital One. These are all household names. However, because of the way the Zelle service payment works, these big-name banks can’t offer you any protection at all if you initiate a transfer to another Zelle customer. According to Zelle’s security page, you are supposed to use Zelle to “Only send money to friends, family and others you trust.” You have to be careful because “once you authorize a payment to be sent, you can’t cancel it if the recipient is already enrolled in Zelle.” Obviously, there is no way for you to know that if you are sending money to a stranger on the Web. You can only cancel a payment if the recipient is not enrolled in Zelle and if you stop a payment that’s in process you are likely to be charged a fee. My bank charges a $25 Stop Payment fee.

| If a person is enrolled in Zelle, there’s no way for you to cancel a processed payment. It’s exactly like sending them cash. |

As far as Zelle is concerned, they are never at fault and therefore you can’t make a claim against them. Unlike, PayPal and eBay that are known for protecting their customers’ purchases, Zelle won’t be able to help you. If you buy the wrong product, it’s your fault so you have no claim. If you buy the correct product, but receive the wrong product, you have no case. If you send money and don’t get your product at all, it’s your fault. If you make a typo and accidentally send the money to the wrong person, it falls under the category “too bad.” With Zelle, you have zero margin for error because you have no purchase protection of any kind. That’s why it’s best to use it only to send money to people you know and trust and for small amounts. To Zelle’s credit, they have made this very clear (see this blog post). They have warned people about most of the things I have pointed out in this article. They don’t try to trick the consumers. The challenge is that transferring money is so easy with Zelle that even a single mistake can be costly. Furthermore, because the digital transactions can take place within seconds, banks are unable to stop illicit transfers.

What is Zelle Good For?

Zelle is only good for sending small amounts of money to someone you know and trust, like your friends and family members. According to Lou Anne Alexander, the group president of payment solutions at Early Warning Services, the company that launched Zelle, “Use Zelle to split the bill with your friends for lunch…But never use it for any sizable transaction, or with anyone you don’t know.” You should only use Zelle to send money that you are okay with risking, whatever that amount might be. Also, remember that you can’t afford to make a typo and risk sending money to the wrong email or phone number. You are not dealing with your credit card company here, which offers fraud protection and dispute resolution. No wonder people have compared Zelle transactions to vaporware.

| With Zelle there is no Purchase Protection, no Fraud Protection, and no Dispute Resolution. If you send money and get scammed, it’s your fault. |

Here’s a comparison of fraud protection offered by various payment services. This will give you an idea where Zelle stands. Click to enlarge the image.

Consumer Reports Score

The editors at Consumer Reports tested five popular payment services for its data privacy and payment authentication practices in 2018. Apple had an outstanding overall score of 76 out of 100. Zelle was last with an overall score of 50. It did poorly on both data privacy and security practices. According to NBC News, the Consumer Report “criticized the Zelle app for not having a way to keep users from accidentally sending money to the wrong person, if they mistype a phone number.” The NBC News article was published in August 2018. Zelle responded by saying that “by the end of October, that confirmation step would be added to the app and used by all financial institutions that offer the service.”

Here are the Consumer Reports test results.

| Payment Service | Test Score Out of 100 |

| Apple | 76 |

| Venmo | 69 |

| Square Cash’s App | 64 |

| Facebook P2P Payment | 63 |

| Zelle | 50 |

Zelle Payment Method

Fraud and Hacking Incidents

There are lots of incidents of fraud associated with the use of Zelle and there have been cases where hackers have literally cleaned out their victims’ bank accounts. According to the New York Times, Genevieve Gimbert, a partner in PwC’s financial crimes unit said “I know of one bank that was experiencing a 90 percent fraud rate on Zelle transactions, which is insane.” Because with Zelle the transactions take place within seconds, the banks are facing difficulty stopping the transactions in process or reversing the illegal transfers.

:max_bytes(150000):strip_icc()/003_how-does-zelle-work-4693192-32a208e147084608a92e9e92a5b189fc.png)

Here are a few examples and stories of victims being hacked and the incidents of fraud taking place through Zelle.

- New York Times: Zelle, the Banks’ Answer to Venmo, Proves Vulnerable to Fraud

- NBC Dallas: Consumers Say Their Bank Accounts Were Hacked Through Zelle

- NBC Chicago: Hackers Easily Drain Cash From Popular Banking App, Experts Warn

- NBC Miami: Consumers Hit With Fraudulent Zelle Transfers

- ABC13.com: $1,000 disappears from aging woman’s bank through Zelle

- TechCrunch: Zelle users are finding out the hard way there’s no fraud protection

- Experian: Here’s What You Need to Know About Zelle

I did some research to find out the net worth of the eight banks that own Early Warning Services, LLC (creator of Zelle). Here’s the breakdown of their total worth of $10,182 billion.

| Bank Name | Total Assets |

| J.P. Morgan Chase Bank | $2,615 billion |

| Bank of America | $2,338 billion |

| Citi Bank | $1,925 billion |

| Wells Fargo Bank | $1,872 billion |

| US Bank | $464 billion |

| PNC Bank | $380 billion |

| Capital One Bank | $362 billion |

| BB&T Bank | $226 billion |

| Total | $10,182 billion (or $10.182 trillion) |

You would imagine that with the financial power of $10.182 trillion these banks could afford to hire developers who can create a system that doesn’t have the issues that Zelle has faced for the past year and a half. One thing’s for sure, it would be safe to assume that the executives at these banks don’t use Zelle to split their lunch with friends, as Lou Anne Alexander had suggested.

How to Avoid Being a Victim

To avoid becoming a victim of fraud, follow the guidelines provided by Zelle and my recommendations in this section. Keep in mind that the Zelle payment system is designed only to send small amounts of money to someone you know and trust, like your friends and family members. Don’t use Zelle to pay strangers at Craigslist or other online services. With Zelle people have been scammed not only as buyers, but also as sellers. If you follow these guidelines, you are likely to stay safe. If you don’t, chances are slim that any bank or law enforcement authority is going to help you.

The Zelle app allows you to add people’s name, email address, and mobile phone number. If you want to send money to someone you KNOW and TRUST, follow these steps to do a Test Run. This test should only take a few minutes.

- Log in to your bank account and create and register for Zelle service. This is very quick because your bank already has your email and phone number. You can always change the email or phone number you want to use with Zelle later.

- Carefully add the contact information of the recipient you trust (e.g. your friend) and verify that there contact information is accurate.

- Send your friend the smallest amount your bank allows to transfer (e.g. $5.00).

- If your friend has an account, the funds will be transferred to her/his account right away. Otherwise, your friend will receive a notification from Zelle to register for their service to accept the transfer.

- Contact your friend to verify the transfer was successful. Most banks will tell you that it can take up to three days for the first transfer, but the future transfers are within minutes. However, don’t be surprised if even the first transfer only takes a couple of minutes.

NOTE: This confirms that you added your friend’s email and/or mobile number correctly and in the future you don’t need to worry about making a typo and sending money to the wrong person. - Ask your friend to add your contact information in Zelle and then send $5.00 to you.

- You should receive the funds in minutes. This proves that your friend added your contact information correctly. It also proves that you followed my Test Run instructions successfully and didn’t lose any money in the process :-).

Zelle Update Contact Method

If you repeat this test run for every individual that you want to send/receive money, you can rest assured that you have eliminated the risk of sending money to the wrong person. And if you only send/receive money to/from people you trust, you’ve practically eliminated the risk of getting scammed by a stranger. Following these guidelines will minimize the risks associated with using Zelle.

| Thanks for reading my article. If you are interested in IT training & consulting services, please reach out to me. Visit ZubairAlexander.com for information on my professional background. |

Zelle Method 2021

Copyright © 2019 SeattlePro Enterprises, LLC. All rights reserved.